on Dec 3, 2024

by Gnosis

in Highlighted

Originally Published on April 15, 2020

We’re thrilled to announce the launch of the Gnosis Protocol, the result of two years of research and development into better ways to trade on Ethereum.

Gnosis Protocol is a fully permissionless DEX (decentralized trading protocol) that enables a new mechanism called ring trades to maximize liquidity. Ring trades especially improve liquidity for illiquid or “long tail” tokens such as prediction market outcome tokens, by facilitating trades not normally possible on traditional trading protocols.

You can try it out and trade today on Mesa, the first dapp built on Gnosis Protocol, or directly on smart contract level using this tutorial.

Permissionless Innovation

Gnosis Protocol is built in the spirit of permissionless innovation. Its fully decentralized architecture means you don’t need Gnosis to build on our protocol. Rather, its serverless design guarantees the protocol will always be available. Anyone can list tokens or build integrations on the smart contract level, and not only does the protocol have no owner, its order settlement process does not rely on any operator. A centralized operator is replaced by open, incentivized competition, in which anyone can submit order settlement solutions¹.

The first dapp built on the Gnosis Protocol pushes the boundaries of what is accepted as decentralized finance today: Mesa is launched and maintained by the dxDAO, a community-owned and operated organization that develops, governs, and promotes DeFi protocols. Available through IPFS and ENS, the Mesa dapp is a general trading interface that supports simple market making strategies for stablecoins on Gnosis Protocol. By using the simple liquidity provision on Mesa, regular users can act as market makers with minimal effort, improve liquidity, and earn a competitive yield.

Ultimately, anyone can build decentralized applications on Gnosis Protocol that make use of its unique properties. We chose to design Gnosis Protocol as a fully permissionless DEX precisely because we see the protocol as core infrastructure to create a better, “horizontal” way to trade on Ethereum.

Introducing Ring Trades

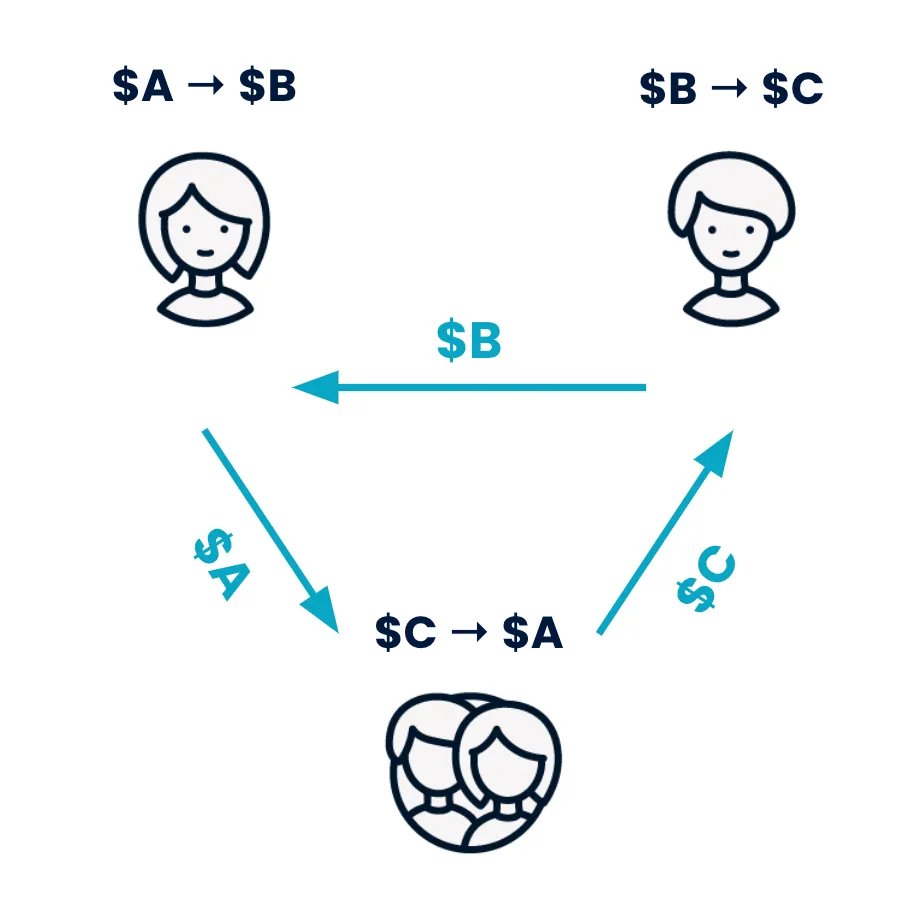

As core infrastructure, Gnosis Protocol enables ring trades. Ring trades are order settlements that share liquidity across all orders, rather than a single token pair.

Let’s start with an example. Imagine a sunny street marketplace where every week vendors and farmers come together to trade their goods. There is only one unusual aspect: no one at this marketplace uses money. Arriving on the scene, local farmer Alice would like to exchange her homegrown Apples ($A) for Bananas ($B). Fortunately, Bob also sets up looking to exchange Bananas ($B) for Apples ($A), and they are able to mutually agree on a price.

However, imagine a slightly more complex scenario. Now in this hypothetical marketplace, Alice would still like to exchange Apples ($A) for Bananas ($B). However, Carlos and Carol both would like to exchange Carrots ($C) for Apples ($A), and Dan would like to exchange Bananas ($B) for Carrots ($C). What will they do?

No direct exchange would be possible. In this example, Dan might have to make an additional trade, exchanging their Bananas ($B) for Apples ($A) to then complete the desired trade for Carrots ($C).

While this marketplace might seem abnormally inefficient, translated into today’s experience of traditional CEXs (centralized trading protocols) or DEXs, most wouldn’t be able to directly fill these orders either. How many of us have been like Dan when we wanted to accomplish a direct trade, but instead had to convert a token into a more dominant asset first? Litecoin Potatoes ($P) anyone?

Scenarios in which token pairs have no liquidity on a given trading protocol or in some cases are not listed at all occur everyday. Although it may seem like only a minor inconvenience, this scenario has negative implications for the viability of open finance as more and more assets are tokenized, and those assets have no liquid market mechanisms.

How, then, can a DEX like Gnosis Protocol address this? Let’s get an owl’s eye view on how the protocol works:

Anyone can list a token on the protocol;

Traders can place limit orders on the protocol at anytime;

Every five minutes, a batch auction runs;

At the start of an auction, all currently open orders on the protocol are considered;

For each auction, an open competition to submit order settlement solutions takes place;

The protocol selects the ring trade order settlement solution that maximizes trader welfare² and provides uniform clearing prices;

All matched orders are settled on-chain and filled;

The next batch auction begins.

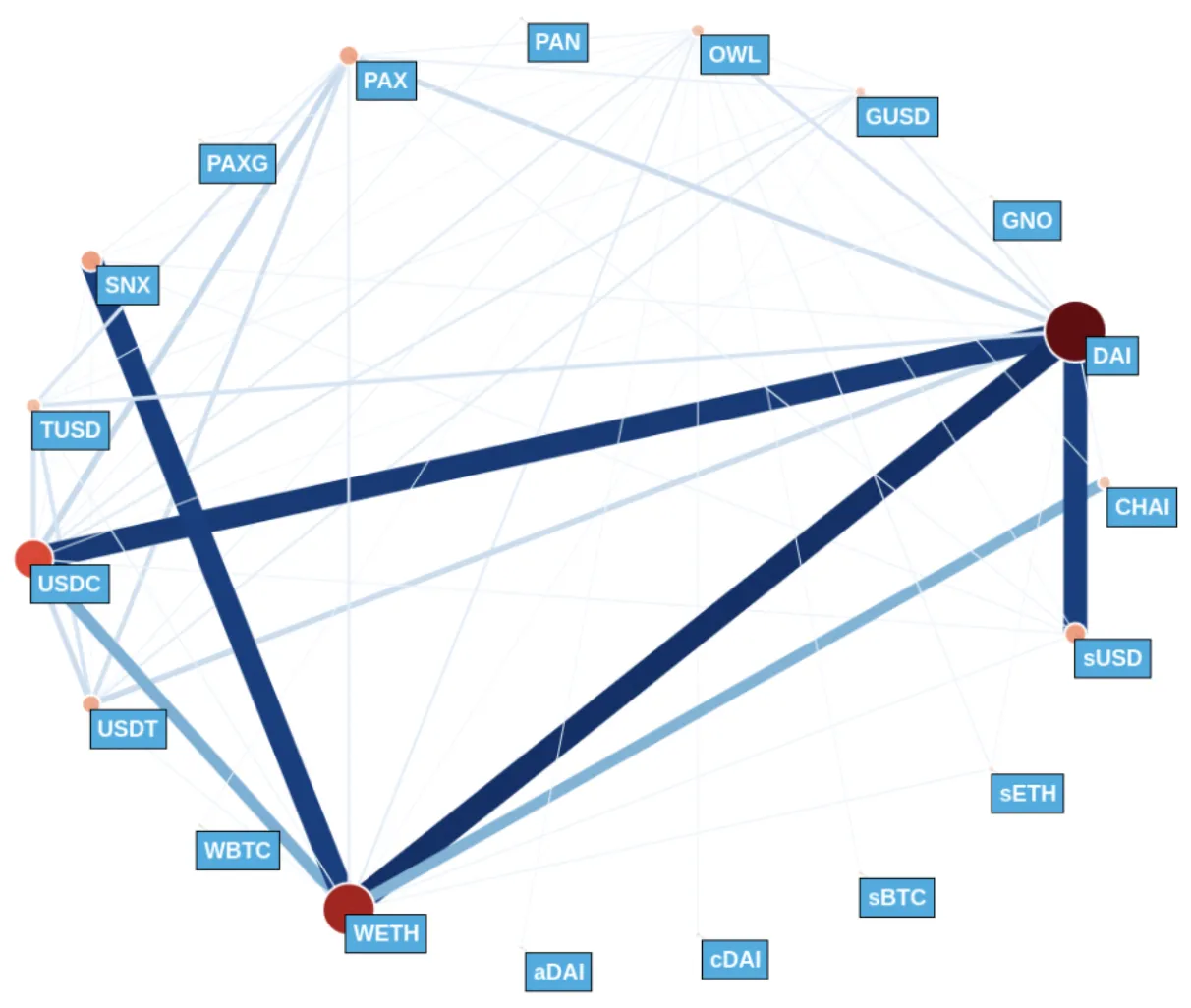

Because the protocol selects for optimized order settlements, in contrast to traditional trading protocols, an order book for Gnosis Protocol may be visualized as such:

Wherein liquidity can be spread between multiple orders in each batch. Translating from the earlier marketplace example, this means that all orders for Apples ($A as $USDC), Bananas ($B as $DAI), and Carrots ($C as $wETH) can be filled with uniform clearing prices and without requiring additional work from the traders.

Going one step further, on Gnosis Protocol, not only would all of these orders be filled, they could be filled in the most optimal order settlement possible. This can be especially useful in fragmented token spaces such as USD stablecoins and their derivatives. Token pairs with no liquidity on a traditional trading protocol can have magnitudes greater liquidity for each intermediary step within a ring trade. For this reason, ring trades are critical infrastructure that enable trading for illiquid and new “long tail” tokens, the number of which will only increase as open finance gains popularity and more and more assets are tokenized.

Gnosis Protocol and Gnosis’ Mission

As our core product, Gnosis Protocol is central to our continued mission, and the protocol is built to be accessible to anyone. On each executed trade, the protocol takes only a 0.1% fee on trading volume. Fees are included in a trader’s limit price and paid in their sell token. All fees are then converted into OWL, which is a token generated by locking the Gnosis token, GNO. 50% of the fee is paid as an incentive to the provider of the selected order settlement solution (“solver”), while the remaining 50% of the fee is burnt. Fees are used both to incentivize an open competition in which anyone can submit an order settlement solution for every batch auction and be rewarded, and to bring value to all GNO token holders.

Our work remains centered on the public adoption of prediction markets. Core to the success and utility of prediction markets, is liquidity. Without lower spread order books, permissionless prediction markets will continue to fail to capture expert knowledge on future events, despite it becoming clearer by the day that open access to accurate information is key to global, collective resilience.

Our existing conditional token framework allows anyone to create crypto assets that represent information about future events with conditional outcomes. In essence, the conditional token framework enables the creation of prediction market assets, which could be traded on any trading protocol, not solely on a prediction market platform. However, the number of unique conditional tokens, each representing a unique outcome in the world, could grow exponentially in size. In order to ensure marketplaces exist for the “long tail” of prediction market assets³, it is necessary to have market mechanisms built precisely for handling large numbers of unique, and often illiquid, tokens. To this end, we built the Gnosis Protocol to become the standard for trading prediction market conditional tokens and providing access to their global liquidity pool.

Ultimately, an underlying hypothesis of Gnosis’ work is that more efficient market mechanisms for prediction markets and other public goods create pathways for inclusion and access to resources. Pathways that could fundamentally rewire how we define economic value as a tool for collective coordination. We sincerely hope that building new tools in no small part contributes to uprooting our reliance on dominant models of financial exchange — for a redistributed future to come.

If you want to learn more about Gnosis Protocol, join the #protocol channel in our Discord server https://chat.gnosis.io.Try out trading on the Mesa dapp, built on the Gnosis Protocol, or place trades directly on smart contract level using this tutorial.See Gnosis Protocol’s live Mainnet stats on Dune Analytics.

Many thanks to Chris Ernst, Martin Köppelmann, and the entire Gnosis Protocol team.

[1] To learn more about how the open competition for order settlement solutions work, visit our Gnosis Protocol Dev Portal.[2] To learn more about how trader welfare is defined and current solvers, watch Gnosis Engineer Felix Leupold’s talk Fair Price Finding In a Decentralized Exchange Economy.[3] Prediction markets may constitute a regulated activity in some jurisdictions depending on market design, market focus, monetization and other factors and may necessitate corresponding regulatory authorizations.

More articles